Health insurance has always been a challenge for digital nomads and travelers. Traditionally, you had two main choices: international health insurance for comprehensive, long-term coverage, or travel insurance for short-term protection covering emergencies and travel issues like trip cancellations or lost luggage.

For years, insurance companies focused on students, expats, or tourists who mostly stayed in one place, making these policies difficult to access or renew once you left your home country. The growing nomad community has pushed some companies to create better solutions. Today, two main providers cater specifically to digital nomads: Genki and SafetyWing.

Both companies offer health insurance for people who travel frequently, but they serve different needs. SafetyWing is known for being budget-friendly, offering basic coverage that works well for nomads who want affordable emergency health insurance. Genki offers more comprehensive coverage, with higher limits and fewer exclusions for those wanting reliable health protection without typical travel insurance restrictions. Genki also covers people up to age 70, making it available to a wider range of travelers.

While both companies have evolved beyond traditional insurance limitations, they take different approaches. Genki focuses purely on health coverage, leaving out travel-related benefits, so you’re not paying for extras you might not need. Instead, they put more into healthcare options, offering broader coverage without strict payout limits. SafetyWing includes some travel-related benefits, which might be better if you want protection for travel issues too.

For Americans, Genki offers more flexible home country coverage – you’re covered for emergencies up to 42 days out of every 180 days, compared to SafetyWing’s 15 days per 90 days. Both companies plan to expand their coverage options for more comprehensive international health insurance soon.

Contents

- 1 Issues with Standard Insurance Policies

- 2 Solution? Genki Insurance!

- 3 Understanding Genki’s Structure

- 4 My Experience with Genki

- 5 Who Can Use Genki?

- 6 Pros and Cons of Genki Insurance

- 7 Understanding Payments and Reimbursements

- 8 Genki’s Insurance Plans

- 9 Which Plan to Choose?

- 10 Understanding Costs

- 11 How to Sign Up (Takes about 5 minutes)

- 12 Getting Reimbursed

- 13 Frequently Asked Questions

Issues with Standard Insurance Policies

I first tried regular travel insurance from a local broker, but these policies had limits on how long I could stay overseas, and I needed new insurance when changing countries. Most couldn’t be purchased while already abroad. This was inconvenient since many expats, like me, travel for long periods, often years at a time.

Solution? Genki Insurance!

Genki (Genki.world) was created by digital nomads who understood these challenges. They offer insurance that works globally for €48 per month, with no restrictions on how long you can stay abroad.

They work with established insurers like DR-WALTER and Allianz Partners, operating under EU regulations. This means you get reliable coverage from respected insurance companies. You can get medical care at any licensed facility worldwide, and they provide 24/7 emergency support. Just note there’s a 14-day waiting period for claims, and they don’t cover pre-existing conditions from the last six months.

Understanding Genki’s Structure

It’s important to know that Genki isn’t an insurance company – they’re a broker working with DR-Walter, a German insurance company. For claims, you’ll deal with MD Medicus (a German assistance company) in most countries, or Global Excel in the US and Canada. Genki connects you with these services, making everything easier to manage.

My Experience with Genki

When I talked with Genki’s team, they clearly explained everything I needed to know. Since they were created by digital nomads, they really understand what long-term travelers need.

Who Can Use Genki?

Anyone can use Genki – there are no citizenship restrictions

Pros and Cons of Genki Insurance

✅Pros:

- Reliable Claims Payments: They consistently pay claims for treatment on time

- Emergency Coverage: They cover urgent treatment costs right away

- Global Coverage: Works worldwide

- No Time Limits: You can travel indefinitely without losing coverage

- Comprehensive Coverage: Includes motorcycle riding, active sports, and even pregnancy. You can do activities like surfing or boxing (as long as it’s not professional)

- Choice of Clinics: Visit any licensed clinic without needing pre-approval

- Unlimited Coverage: No caps on insurance payouts (though avoid unnecessarily expensive services)

- Home Country Coverage: Covers emergencies in your home country

- Pregnancy and STD Coverage: Includes pregnancy and STD treatment

- Flexible Subscription: Monthly auto-renewal that you can cancel anytime

❌ Cons:

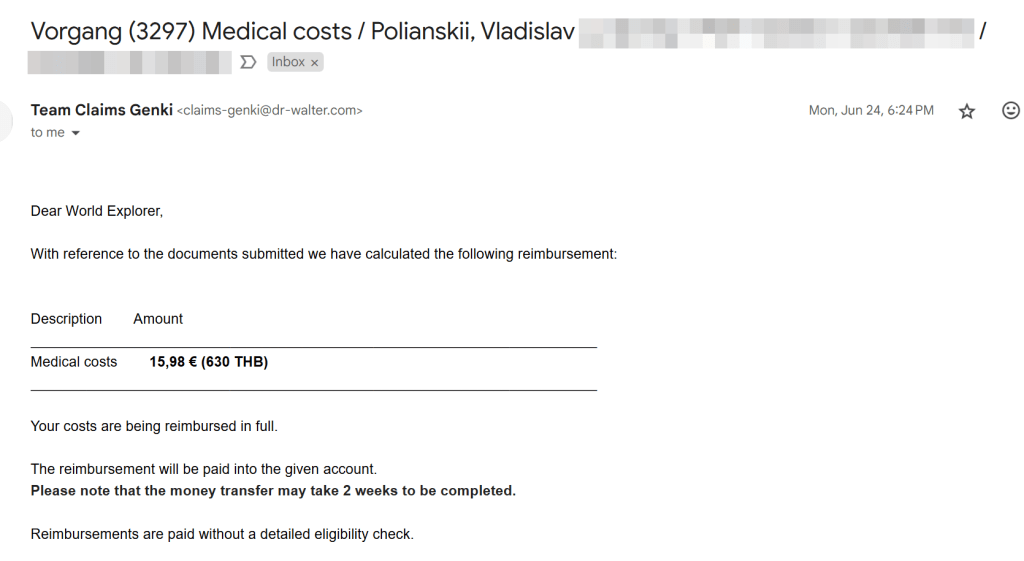

- Upfront Payments: For non-emergencies, you pay first and get reimbursed in 2-4 weeks

- Higher Cost Without Deductible: Costs about €50 more if you don’t want a deductible

Understanding Payments and Reimbursements

While most local insurance companies pay for treatment directly, with Genki you typically need to pay first and get reimbursed later. This might seem less convenient, but there’s a trade-off: local insurance usually limits overseas stays to 45-90 days, while Genki has no such restrictions.

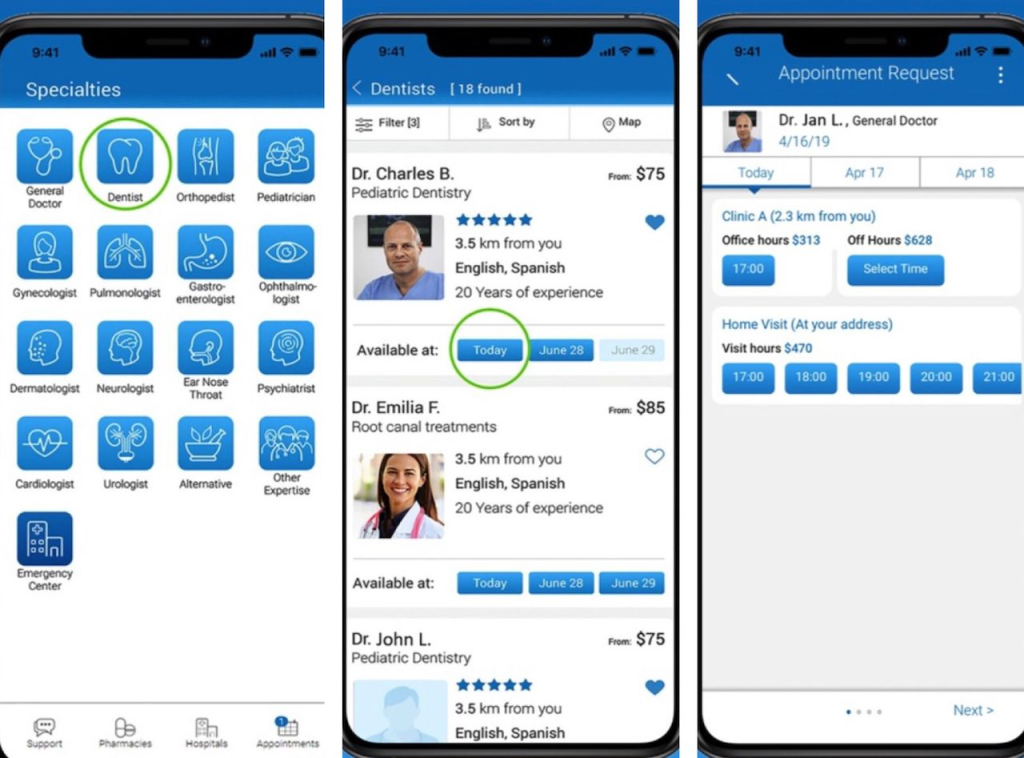

Using Air Doctor to Find Medical Care

Air Doctor is a convenient app that connects you directly with Genki’s insurance coverage. Here’s how it works:

- Find and book appointments with local doctors worldwide

- Visit specialists or general practitioners

- Get telemedicine consultations in multiple languages

- Receive prescriptions from local doctors online

The best part is that appointments booked through Air Doctor are handled directly by the insurance company – you don’t have to pay upfront for the visit or any medicine received at the clinic. (You’ll only need to pay for prescriptions filled at outside pharmacies, which you can then submit for reimbursement.)

From personal experience, Air Doctor has been invaluable for handling various health issues while traveling – from skin conditions in Thailand to food poisoning and minor injuries like knee problems. It’s especially useful for those everyday health concerns where you just need to see a doctor without dealing with paperwork and waiting weeks for reimbursement.

Important Update About AirDoctor Integration (November 2024)

As of recent changes, Genki Explorer‘s direct payment feature through the AirDoctor app is no longer available. While you can still use AirDoctor to find doctors and book appointments, you’ll need to pay upfront and request reimbursement through Genki’s Member Center (typically takes about two weeks).

This doesn’t affect your insurance coverage – you can still:

- Visit any doctor or hospital of your choice

- Use AirDoctor to find and book medical appointments

- Get reimbursed for covered treatments through Genki’s Member Center

For emergencies and hospital stays:

- Go to any hospital providing emergency care

- Have them contact Genki’s 24/7 emergency assistance

- Direct payments may still be possible for emergency hospital care

This change only affects outpatient visits (regular doctor appointments and examinations), which now require upfront payment and reimbursement, which is standard practice for many international insurance providers.

Payment Methods

Genki processes reimbursements through bank accounts (using IBAN numbers for European accounts), Wise, or PayPal. From personal experience, payments to European bank accounts work smoothly using IBAN numbers.

Genki’s Insurance Plans

Genki offers three insurance plans. Here’s an overview of these options on the Genki website (available in English):

- Genki Explorer

- Genki Native (Standard and Premium)

Here’s a comparison table:

| Feature | Genki Explorer | Genki Native | Genki Native Premium |

|---|---|---|---|

| Duration | 1 month to 2 years (renewable) | 1 year | 1 year |

| Monthly Cost | From €48.30 | From €180 | From €260 |

| Coverage Area | All countries | All countries | All countries |

| Age Limit | 0-69 years | 0-55 (or up to 79 if started before 55) | 0-55 (or up to 79 if started before 55) |

| Home Coverage | 42 days/180 days (emergencies) | Up to 30 days/year (€250,000 limit) | No time limits |

| Sports Coverage | All non-professional sports, except diving, climbing, parachuting, paragliding, base jumping, bungee jumping, skydiving, and racing | All non-pro sports | All non-pro sports |

| Motorcycle Coverage | Yes | Yes | Yes |

| Coverage Type | Any accidents, emergencies, and treatments such as ear infections, flu, or toothaches. Partial pregnancy coverage after 11 months of insurance | All Explorer coverage + chronic diseases | Includes all previous benefits + improved pregnancy coverage, preventive care (checkups, dentistry, vaccination), private rooms, and child care during treatment |

| Coverage Limit | Unlimited | Up to €1,000,000/year | Unlimited |

Important Notes:

- First 14 Days: If you start while already abroad, only accidents and emergencies are covered initially

- Cost Factors: Price varies by age, deductible choice, and US/Canada coverage limits

- Pre-existing Conditions: After two years with Explorer, conditions treated under the policy become pre-existing and aren’t covered on renewal

- Family Coverage: You can add family members, but each person costs the full rate

- Exclusions: Doesn’t cover travel issues like lost baggage or flight delays

Which Plan to Choose?

If you have health insurance in your home country and don’t mind public clinics, Genki Explorer works well. For more comprehensive coverage, consider Genki Native or Native Premium.

Understanding Costs

Two main factors affect your premium:

- US/Canada Coverage: Limiting your time in these countries to 42 days per 6 months reduces cost

- Deductible Choice: Plans with a deductible cost less. For example, with a €50 deductible on a €1,000 treatment, you pay €50 and insurance covers €950

Genki Explorer Pricing

| Age | USA & Canada | Deductible | Monthly Cost |

|---|---|---|---|

| 0 – 29 | Restricted | With deductible | €48.30 |

| 0 – 29 | Restricted | No deductible | €96.30 |

| 0 – 29 | Unrestricted | With deductible | €96.30 |

| 0 – 29 | Unrestricted | No deductible | €153.30 |

| 30 – 39 | Restricted | With deductible | €57.30 |

| 30 – 39 | Restricted | No deductible | €105.30 |

| 30 – 39 | Unrestricted | With deductible | €114.30 |

| 30 – 39 | Unrestricted | No deductible | €174.30 |

| 40 – 49 | Restricted | With deductible | €72.30 |

| 40 – 49 | Restricted | No deductible | €123.30 |

| 40 – 49 | Unrestricted | With deductible | €156.30 |

| 40 – 49 | Unrestricted | No deductible | €225.30 |

| 50 – 59 | Restricted | With deductible | €105.30 |

| 50 – 59 | Restricted | No deductible | €162.30 |

| 50 – 59 | Unrestricted | With deductible | €231.30 |

| 50 – 59 | Unrestricted | No deductible | €315.30 |

| 60 – 69 | Restricted | With deductible | €168.30 |

| 60 – 69 | Restricted | No deductible | €240.30 |

| 60 – 69 | Unrestricted | With deductible | €378.30 |

| 60 – 69 | Unrestricted | No deductible | €492.30 |

Genki Native Pricing

| Age | Plan | Deductible | Monthly Cost |

|---|---|---|---|

| 0-19 | Premium | No deductible | €210 |

| 0-19 | Premium | €500 | €200 |

| 0-19 | Premium | €1000 | €189 |

| 0-19 | Standard | No deductible | €160 |

| 0-19 | Standard | €500 | €153 |

| 0-19 | Standard | €1000 | €145 |

| 20-24 | Premium | No deductible | €260 |

| 20-24 | Premium | €500 | €246 |

| 20-24 | Premium | €1000 | €231 |

| 20-24 | Standard | No deductible | €180 |

| 20-24 | Standard | €500 | €171 |

| 20-24 | Standard | €1000 | €162 |

| 25-29 | Premium | No deductible | €260 |

| 25-29 | Premium | €500 | €246 |

| 25-29 | Premium | €1000 | €231 |

| 25-29 | Standard | No deductible | €180 |

| 25-29 | Standard | €500 | €171 |

| 25-29 | Standard | €1000 | €162 |

| 30-34 | Premium | No deductible | €260 |

| 30-34 | Premium | €500 | €246 |

| 30-34 | Premium | €1000 | €231 |

| 30-34 | Standard | No deductible | €180 |

| 30-34 | Standard | €500 | €171 |

| 30-34 | Standard | €1000 | €162 |

| 35-39 | Premium | No deductible | €280 |

| 35-39 | Premium | €500 | €264 |

| 35-39 | Premium | €1000 | €248 |

| 35-39 | Standard | No deductible | €200 |

| 35-39 | Standard | €500 | €190 |

| 35-39 | Standard | €1000 | €179 |

| 40-44 | Premium | No deductible | €340 |

| 40-44 | Premium | €500 | €320 |

| 40-44 | Premium | €1000 | €299 |

| 40-44 | Standard | No deductible | €230 |

| 40-44 | Standard | €500 | €217 |

| 40-44 | Standard | €1000 | €204 |

| 45-49 | Premium | No deductible | €410 |

| 45-49 | Premium | €500 | €385 |

| 45-49 | Premium | €1000 | €359 |

| 45-49 | Standard | No deductible | €290 |

| 45-49 | Standard | €500 | €273 |

| 45-49 | Standard | €1000 | €255 |

| 50-54 | Premium | No deductible | €510 |

| 50-54 | Premium | €500 | €477 |

| 50-54 | Premium | €1000 | €444 |

| 50-54 | Standard | No deductible | €370 |

| 50-54 | Standard | €500 | €347 |

| 50-54 | Standard | €1000 | €323 |

| 55-59 | Premium | No deductible | €650 |

| 55-59 | Premium | €500 | €607 |

| 55-59 | Premium | €1000 | €563 |

| 55-59 | Standard | No deductible | €480 |

| 55-59 | Standard | €500 | €448 |

| 55-59 | Standard | €1000 | €417 |

How to Sign Up (Takes about 5 minutes)

- Visit join.genki.world/as/explorer

- Enter age and add any additional people

- Choose your options (deductible, US/Canada coverage)

- Fill in personal details (email, name, gender, birth date, home country, start date)

- Verify your email

- Complete payment and access your account

Getting Reimbursed

- Log into your Genki account

- Go to “Compensation”

- Select your active policy

- Enter:

- Full name

- Payment details (bank, Wise, or PayPal)

- Upload medical receipts (including taxi to clinic if needed)

- Describe your treatment

- Wait 2-3 weeks for reimbursement

Frequently Asked Questions

-

Does it work for visas and border crossings?

Yes, it’s valid for both.

-

When does coverage start?

Explorer: Day after enrollment

Native: 7 days after application -

Can I buy while already traveling?

Yes, but only emergencies are covered in the first 14 days.

-

Is Genki Insurance Legit?

Genki Insurance is registered in Germany, indicating a solid corporate presence. They are backed by Allianz Partners, a well-established insurance company, which enhances their credibility. Claims handling is managed by DR-WALTER, a reputable claims management company, ensuring a professional approach to customer claims.

With a 4.4/5 Trustpilot rating from 551 customer reviews, Genki Insurance shows a high level of customer satisfaction. Customers appreciate their user-friendly processes, quick responses, and prompt reimbursement of medical expenses. The company aims to be a long-term health partner for nomads, prioritizing comprehensive and sustainable healthcare solutions. As with any insurance provider, thorough review of policies and terms is recommended before purchase.

-

Will Genki cover a scooter crash?

Yes. Even if you don’t have a driver’s license or helmet, as long as you’re not intoxicated. I’ve personally reached out to Genki and got the confirmation that this is indeed the case.